You can calculate the average cost by figuring out the total cost of production and then dividing that sum by the number of units you produce. If it costs $100 to produce 100 widgets, then the average cost is $1. It reduces the total cost of production by establishing smarter ways of working, reducing downtime, and ensuring cost-effective inventory management for manufacturing stock. Lean manufacturing also allows for more flexibility in the production process, enabling you to respond quickly to unexpected shifts in supply or demand. Here’s a quick summary of the various types of production costs and how they’re defined in a manufacturing setting. There may be options available to producers if the cost of production exceeds a product’s sale price.

Factory overheads, considered secondary to prime costs, are all indirect expenses related to factory management including cost of machine Depreciation. Average costs are the mean per-unit cost of producing goods or services, calculated by dividing total costs by the number of units produced or sold. To keep things simple, production costs are expenses incurred when producing your product or service. Manufacturing costs, on the other hand, relate to only the expenses that are required to make your product or service. Understanding how business production costs work is a critical part of any type of company.

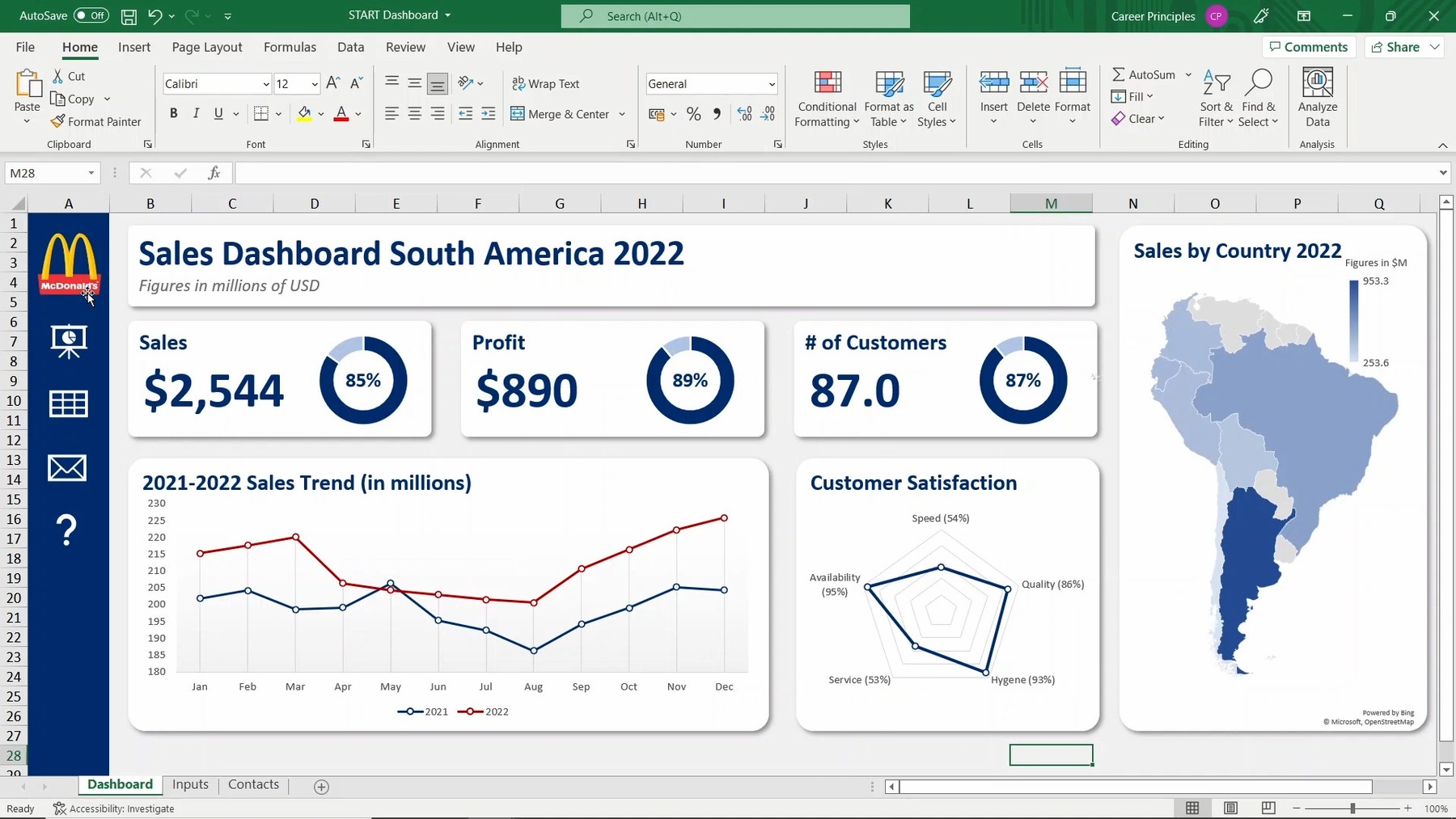

Average Cost

Tracking the cost of production is essential for understanding the profitability of your business. Article by Oliver Munro in collaboration with our team of specialists. Oliver’s background is in inventory management and content marketing. He’s visited over 50 countries, lived aboard a circus ship, and once completed a Sudoku in under 3 minutes (allegedly).

Marginal cost

Indirect costs incurred during the production process that cannot be directly attributed to specific units of output. Period costs, also known as operating expenses, are expenses incurred during a specific period not directly tied to the production of goods or services. These costs are expensed on the income statement in the period in which they are incurred and are not included in the valuation of inventory.

Period costs

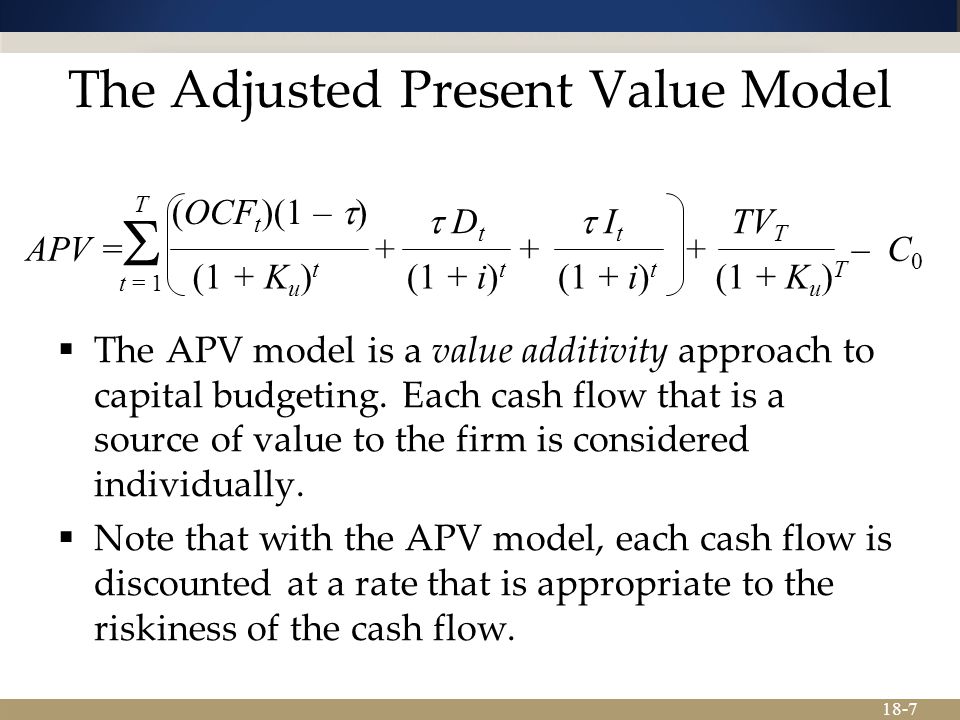

Marginal costs are those costs that come about due to a company producing additional goods because of accidental damages or other causes. These costs, however, don’t impact the fixed costs, but they can increase the variable cost. The goal of the company should be to minimize the average cost per unit so that it can increase the profit margin without increasing costs. Fixed costs tend to be time-limited, and they are only fixed in relation to the production for a certain period.

- We also included a formula for your calculations to help stay on track.

- The first step when calculating the cost involved in making a product is to determine the fixed costs.

- These costs are directly attributable to the production of goods or services and typically vary with the level of production or sales.

- We have resource management features that ensure your production teams are working at capacity.

That way, you know how much the project is going to cost, which informs if you initiate what is and how does an accounting department structure work the project or pass on it. Put another way, being able to calculate the cost of production helps you estimate your net profit or net loss on sales. That informs the retail price you put on the product and shows how high you can go without alienating your customers or negatively impacting your profits. A production order will contain information such as how many units will be produced, what materials and labor costs will be needed, and how much will be expected to cover fixed costs. Marginal cost is the cost incurred by producing an additional unit. It specifically measures the change in total cost when production output increases by one unit.

Factory overhead’ is a term used in business management for expenses related specifically with the cost of maintaining the premises, plant and equipment within a factory. Factory overhead costs may include items such as electricity, heat, power, rent, Depreciation on machines or even the supervisor’s salary. Costs not included with factory overhead are selling costs and general administrative expenses. The main component of production cost is prime cost, also known as direct material and direct labour.

Maintenance Costs

We also included a formula for your calculations to help stay on track. Indirect costs are important because they contribute to the overall cost structure of the business and impact profitability indirectly. While not directly tied to production activities, indirect costs are essential for maintaining the operational infrastructure and supporting various functions within the organisation. Here’s a hypothetical example to show how this works using the price of oil.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. This information was taken from the books of a manufacturing concern. This means consolidating purchases with fewer suppliers to leverage volume discounts and establish better relationships with your vendors. Try to negotiate long-term contracts to increase pricing stability and predictability. Costs related to ensuring that products meet quality standards and specifications.

To arrive at the cost of production per unit, production costs are divided by the number of units manufactured in the period covered by those costs. Prices that are greater than the cost per unit result in profits, whereas prices that are less than the cost per unit result in losses. When you produce a product or service, production costs are any expenses incurred along the way.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Take your learning and productivity to the next level with our Premium Templates. Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses!

Cost of production is the total expenses incurred by a business or manufacturer to produce goods or services. Average cost of production refers to the per-unit cost incurred by a business to produce a product or offer a service. Production costs may include things such as labor, raw materials, or consumable supplies.

Keep in mind that any fixed or variable costs you include must get incurred while producing your product or service. Just add the total fixed costs from a specific period of time to the total variable costs over the same period. When you add together both the variable costs and fixed costs they’re going to equal the total cost. Essentially, this is the total cost incurred for production including any changes to production volume. It’s also important to recognize that simply reducing production costs won’t necessarily generate more profit.

The first step aipb certification test when calculating the cost involved in making a product is to determine the fixed costs. The next step is to determine the variable costs incurred in the production process. Then, add the fixed costs and variable costs, and divide the total cost by the number of items produced to get the average cost per unit. For example, the production costs for a motor vehicle tire may include expenses such as rubber, labor needed to produce the product, and various manufacturing supplies.