The commercial ecosystem and the competing infrastructure are highly applicable to a new business. Lenient government policies and transparency make it attractive to investors. Sign in to create your job alert for Part Time Accounting jobs in Minnesota, United States. Sign in to create your job alert for Part Time Accounting jobs in California, United States. The terms and conditions within such Customer Contract shall control to the extent of any direct conflict with these Terms of Use.

An Account Payable Report shows the total funds spent by a business on its various accountabilities, including private loans, utility payments and raw material purchases. CDA analyses the accountabilities of your company and preparers the Accounts Payable Entry as per the requirements. Managing the accounts payable is one of the strategic facts to streamline the cash flow of the company.

Part Time Accounting Clerk

RETIREMENT PENSIONThe City contributes 14% monthly toward retirement benefits offered through the Ohio Public Employee Retirement System. The employee pension payment share is 10% of gross salary.Personal Leave Eligible for 24 hours of personal leave if more than 500 hours worked in previous calendar year.Eligible for 40 hours of personal leave if more than 1000 worked in previous calendar year. Please help us protect Glassdoor by verifying that you’re a

real person. If you continue to see this

message, please email

to let us know you’re having trouble.

Upon a verified and permissible request where no exception applies, we will delete your personal data where we are a controller, and instruct applicable service providers to do the same. During your use of the Services, you may have the opportunity to visit or link to other websites, including websites by third parties unaffiliated with us. These websites might collect personal data about you, and you should review the privacy Part time accounting policies of such other websites to see how they treat your personal data. If you download or access content on our Services or attend an event or webinar we host or co-host, we may share your personal data with sponsors of the event or webinar. The sponsor may also be a controller of your personal data in this instance, and processing of your personal data will be subject to the sponsors’ privacy statements as well.

Frequently Asked Questions on Part-Time Accounting Services

Browse thousands of study programs from around the world.Higher education is more than a college degree. ACADEMICCOURSES connects students with educators providing courses, preparatory years, short programs, certificates, diplomas, and more. ACADEMICCOURSES is part of the Keystone Education Group family of student-centered websites that help students and higher education institutions find each other online. Trusted by students since 2002, ACADEMICCOURSES is your multilingual gateway to higher and continuing education close to home and around the world.

They’re going to come to your office for the required amount of your time and assist with this problem. As soon because the project is completed or the required time is over, they might return to the third-party firm where they might be re-hired by the other firm in need. You have the right to request deletion of your data unless an exception applies.

If your current or former employer uses one of our Services, personal data you input into those Services is accessible by that employer’s end users – subject to the security and access controls set up by the employer. In addition, if you sign up for an Access membership, we may share your personal data with Customers and their designated agents for recruitment purposes or to demonstrate to Customers or potential Customers products designed to enhance their recruitment capabilities. In this Section we set out general categories of personal data we may collect and the purpose for using your personal data, including the personal data collected and processed over the past year.

Your personal data will be appropriately disposed in a manner designed to ensure it cannot be reconstructed or read. If you are a job applicant, after your account has been closed, we may retain Platform Data as permitted by law. Upon making your personal data available to an employer (our Customer), your personal data may be controlled by our Customer. In this regard, we are a data processor for personal data Customers maintain have us process, and your data rights are subject to our Customers’ internal policies. For these reasons, we are not in a position to directly handle data requests for personal data controlled by Customers. You should contact the Customer regarding personal data they may hold about you and to exercise any data rights you may have.

The company offers annuities, life insurance, and long-term care protection. Bank closing by booking bank charges and managing the PDC will be led by CDA. CFS is the financial statement prepared to show all the cash inflows and cash outflows of a company. The investors can recognize the running operations of the company, the source of the money, and the way of its spending.

Accounts Receivable Specialist, Corporate – Virtual/Remote

Part time learning allows one to obtain part-time degrees even if one cannot attend school on a full-time basis. One can learn at his or own pace, gradually accumulating credits which count towards final qualification. Beware of phishing scams targeting job seekers with scammers posing as JAC Recruitment consultants. An agent-owned, cloud-operated brokerage, eXp Realty helps real estate agents interact, collaborate, and learn no matter where they are.

- The Accounting Generalist is responsible for overseeing and collaborating with the SOLID Director of Operations, Human Resources Manager, and Project Management Office to ensure that the company is operating at high levels across all business support departments.

- Our highly experienced team makes sure that business firms make their way into the market with a sound financial strategy about their investment.

- Lenient government policies and transparency make it attractive to investors.

- Randstad works with clients in several industries, including finance and accounting, engineering, healthcare, IT, and more.

The Accounting Generalist will manage the financial health of our organization in order to promote success and growth while maintaining legal financial practices. Duties include financial planning to determine how to pay off liabilities and grow the business, reviewing financial documents to ensure tax-compliance, collaboration with other departments to achieve monetary goals, and managing all accounting related activities. A professional staffing and consulting powerhouse, Robert Half International provides specialized financial recruitment services, with a focus on accounting and finance, technology, legal, creative, marketing, and administration. Companies that both embrace work flexibility and hire for remote accounting jobs range from the large accounting firms to smaller businesses and nonprofits. Besides offering part-time accounting services in UAE, CDA offers all other business-related services like CFO services, Internal & External Audit Services, Audit in Free Zone, VAT Return Filing Services, and many other services related to your business needs.

Share this job

All changes are effective immediately when we post them and apply to all access to and use of the Services thereafter. Your continued use of the Services following the posting of revised Terms of Use means that you accept and agree to the changes. You are expected to check this page from time to time so you are aware of any changes, as they are binding on you. We use an automated chat bot within some of our Services to screen your requests and questions.

The role will oversee the day-to-day activities of the company’s accounting systems and financial assets. The Accounting Generalist will collaborate with the Director of Operations and other SOLID senior leaders to develop, manage, and implement company-wide and departmental budgets. The Accounting Generalist is responsible for overseeing and collaborating with the SOLID Director of Operations, Human Resources Manager, and Project Management Office to ensure that the company is operating at high levels across all business support departments.

Part-time Finance Manager

When we provide our Services to our Customers, the Customer generally controls and manages the personal data, and we process personal data as a data processor or service provider. Our legal obligations as a processor and service provider are set out in our Customer contracts and policies. We share personal data with services providers to provide services on our behalf. These legitimate interests include contacting you to provide support or sending you marketing information (subject to applicable law); detecting, preventing, and investigating illegal activities and potential security issues; and maintaining and improving our Services. We will balance our interests, the purpose and necessity of processing, and the rights and risks to you before we process for legitimate interests.

Due to this role’s access to privileged and sensitive information, this position will require and is dependent on the successful completion of a credit background check and a criminal background check. Over the past 50 years, we’ve grown into a leader in staffing and human resources. From the beginning, our mission has always been to make business simple for Hawaii’s employers and jobseekers. Receive job search tactics to find the best opportunities for you and tips for crafting your resume for remote-friendly employers.

We collect and process personal data to provide you the Services, fulfill our contractual responsibility to deliver the Services to our Customers, fulfill your requests, and pursue our legitimate interests and our business and commercial purposes. We also automatically collect data during your usage and collect other personal data about you from other sources. Your personal data will only be collected and used for purposes stated herein, where you provide additional consent, or as required by law or regulation – including national security or law enforcement requirements.

Your Rights and Control under EU GDPR.

By hiring different accountants, you can select the best for your concern as a Full-Time Accountant later. This website is owned and operated by Governmentjobs.com, Inc. (DBA “NEOGOV”). Our principal place of business is at 2120 Park Place, Suite 100, El Segundo, CA 90245, United States.

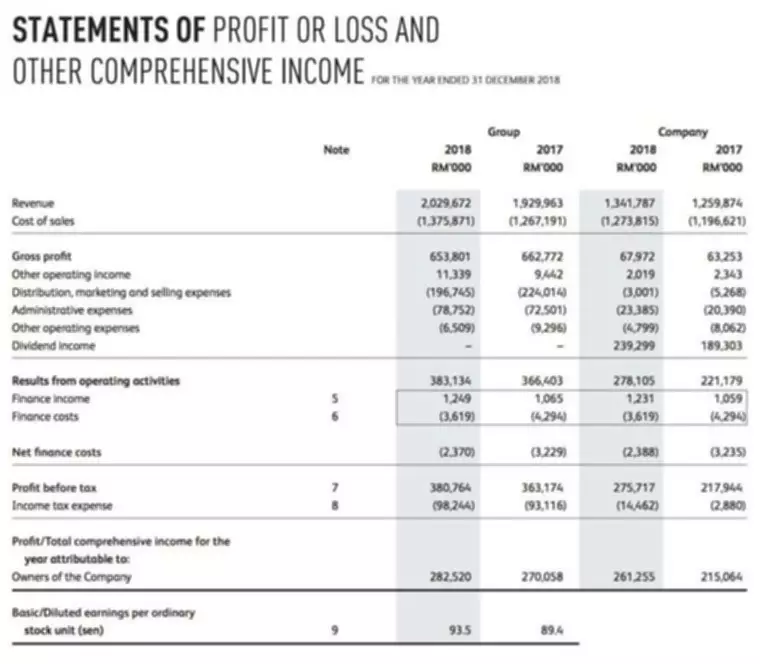

It gives an insight into the financial operations of a company and its position as it shows the assets, liabilities and the equity of a company. CDA prepares the report of the current assets against the long-term assets and the current liabilities against the long-term liabilities that would help you to understand the working capital and the current ratio of your company. Trial Balance is the record of all credits and debits or the file of the closing balances of ledger accounts on a particular period. An audit report is mandatory in terms of bank financing and legal requirements. Although we maintain the controls listed herein, transmission of data is not without risk and we complete security of your personal data cannot be guaranteed.

Work is reviewed through system checks, and balances, in accordance with procedures. Supporting Strategies offers outsourced operational support and financial services, including bookkeeping, HR, payroll, accounts payable, and billing and accounts receivable. While many companies hire accounting and financial professionals, not every company allows them to work remotely. The physical demands described here are representative of those that must be met by an individual to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions.

.jpg)

.jpg)